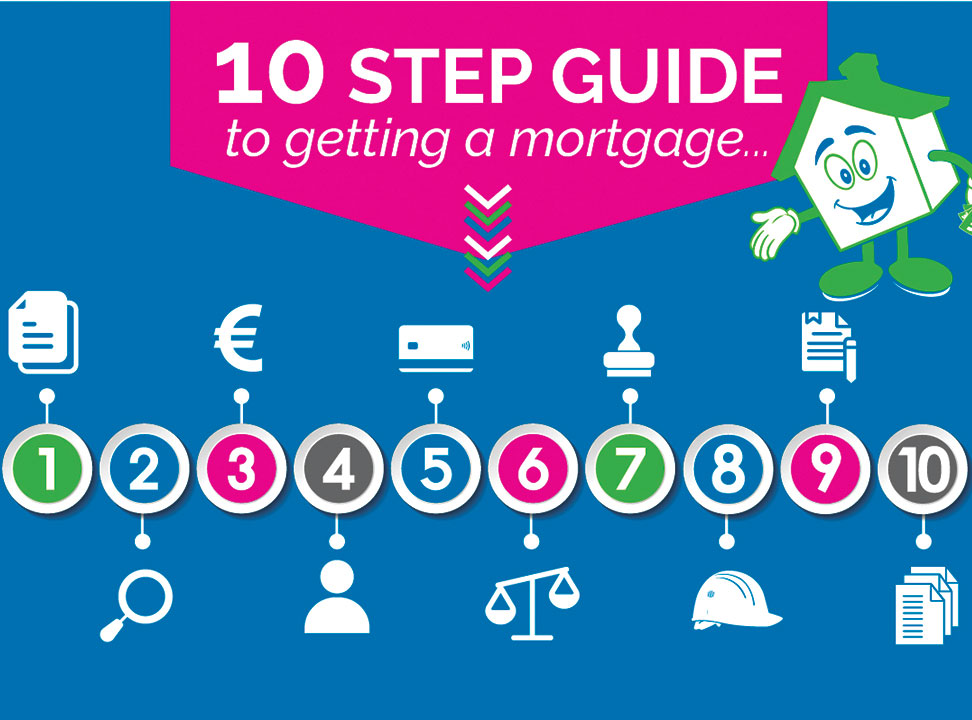

A Complete 10-Step Guide to Obtaining a Mortgage

Setting off on the path to purchasing your inaugural home is undeniably an exhilarating moment. The prospect of unearthing the ideal abode in a neighborhood that resonates with your preferences and becoming an integral part of a vibrant community is a source of anticipation. Beyond the emotional gratification, homeownership stands as a substantial milestone within your personal financial portfolio.

Yet, the journey to becoming a first-time homeowner is often riddled with a myriad of challenges and potential setbacks. To ensure that you are well-prepared to seize your dream home when it emerges on the housing market, you must surmount the hurdles associated with obtaining a home loan. To facilitate this process, adhere to these ten steps to gain insights on how to secure a home loan and devise a robust financial plan for what is arguably the most substantial purchase you’ll ever make.

Guiding Your Way: A Decade of Steps Towards Mortgage Success

Step 1: Scrutinize Your Credit Score

The first pivotal step involves an evaluation of your credit score. Your credit score holds considerable sway over the type of loan you qualify for and the interest rates you’ll be offered. It’s crucial to note that the credit score obtained from a free credit report website differs from the one utilized by banks and mortgage companies to grant loan approvals. Although a free credit report provides a baseline, it is imperative to engage directly with your bank or mortgage broker to gain a comprehensive understanding of the factors that shape their scoring criteria. Request the credit report employed for loan pre-approval, enabling your loan officer to furnish guidance on any necessary enhancements required to meet the loan prerequisites. Importantly, remember that you are not obliged to collaborate with the lender that pre-approves your loan; you retain the freedom to explore multiple options and select the one that aligns best with your unique requirements.

Step 2: Define Your Home-Buying Financial

Framework Your credit score wields substantial influence over your loan’s interest rate, which subsequently dictates your monthly mortgage payment. To ascertain the precise price range within your financial means, it is imperative to undergo the pre-approval process. Equipped with your credit score and other pertinent financial information, your lender can pre-qualify you for a home loan, offering an initial estimate of the borrowing range and the associated interest rate. While these figures are not cast in stone until the pre-approval process culminates, they serve as an initial reference point to gauge affordability. Employ online mortgage payment calculators to factor in ancillary costs, such as property taxes, HOA fees, private mortgage insurance (PMI), and homeowner’s insurance, thereby crystallizing a more lucid projection of your monthly mortgage obligations. This exercise is instrumental in establishing a realistic price range for your potential residence.

It is imperative to exercise prudence when perusing available properties. Although you may qualify for a mortgage based on your financial profile, it is vital to acknowledge the inevitability of unanticipated expenses associated with homeownership, including repairs and upgrades. Overspending on your mortgage payments can lead to financial strain, leaving you ill-equipped to address these unforeseen outlays.

Step 3: Amass Resources for Your Down Payment

The down payment you can contribute plays a pivotal role in the mortgage application process. It serves as a tangible demonstration of your commitment and vested interest in the property transaction. The requisite down payment amount varies depending on the type of loan you qualify for, yet options for down payment assistance programs exist. Additionally, a substantial down payment may obviate the necessity for private mortgage insurance (PMI), an additional expense levied on your mortgage payment in cases where your down payment falls short of 20% of the home’s purchase price. PMI serves as a protective measure for the lender in the event of a default on mortgage payments. To embark on your journey toward homeownership, explore strategies for saving towards a down payment, thus inaugurating your pursuit of property acquisition.

Step 4: Secure Pre-Approval for a Mortgage Loan

It is imperative to distinguish between pre-qualification and pre-approval, as they represent distinct phases within the loan approval process. Pre-qualification offers an initial overview of your income, credit score, and financial obligations, delineating a preliminary range for the loan amount. Conversely, the pre-approval process entails a more comprehensive and time-intensive evaluation, necessitating specific documentation and an in-depth scrutiny of your financial history. This entails your most recent W-2, the last two pay stubs, prevailing bank and brokerage account statements, and tax returns from the preceding two years. The actual approval amount is ascertained by the lender upon identifying a suitable property.

Step 5: Compare Offers from Various Lenders

The liberty to seek pre-approval from multiple lenders is a prudent approach, and it is advisable to consult with a minimum of three to assess your options comprehensively. A thorough understanding of each lender’s terms pertaining to loan payments, interest rates, and the cumulative cost over the loan’s tenure is indispensable. Further, it is essential to familiarize yourself with standard fees, inclusive of the loan origination fee, discount points (a mechanism to reduce interest rates), and other charges associated with loan processing. These fees exhibit variance across lenders, necessitating a meticulous examination of offers to gauge their impact on your overall financial landscape.

Step 6: Identify Your Ideal Real Estate Agent and Commence Property Hunting

Now equipped with essential financial insights, you can embark earnestly on the quest to identify the perfect domicile. Armed with an understanding of how to secure a home loan and the attendant implications, you are better positioned to identify the most suitable property. Concurrently, the selection of a real estate agent who harmonizes with your preferences and work ethos becomes paramount. The prudent course of action is to conduct interviews with multiple agents, identifying one who comprehends your requirements, exhibits a commitment to your objectives, and aligns with your personal disposition. Given the potential duration of the collaboration and its significant impact on your home-buying experience, compatibility is crucial.

Step 7: Uphold Your Credit Standing

The preservation of your creditworthiness is imperative throughout the home loan process. Continuing to meet your financial obligations, such as credit card payments, outstanding debts, or student loans, unless otherwise advised by your lender, is a pivotal component. Avoiding substantial acquisitions, such as vehicles or watercraft, as well as postponing expenditures related to prospective home furnishings, like furniture or electronics, is advisable. Your lender will conduct a final review of your creditworthiness immediately preceding the final loan pre-approval, underscoring the importance of adhering to the counsel provided by your loan officer.

Step 8: Maintain employment stability

The foundations of your pre-qualification and pre-approval rest upon your existing employment status and your financial history spanning the preceding two years. Abrupt alterations in your employment situation can influence your eligibility for a loan. In scenarios where changes in employment are inevitable, it is recommended to engage with your lender to chart the subsequent steps.

Step 9: Extend an offer

Upon identifying your ideal residence, the time is ripe to make an offer. Collaborating closely with your real estate agent is crucial to determining a purchase price that harmonizes with your financial capacity and resonates with the seller. Ensuring that your offer remains comfortably within the bounds of your pre-approval amount is imperative to circumvent overcommitment, thereby preserving flexibility to address unanticipated expenditures. In situations marked by intense competition, consideration should be given to composing a personal letter to the seller, elevating the appeal of your offer.

Step 10: Attain Final Approval for Your Home Loan

As you locate the dwelling of your dreams, your lender will share in your excitement. During the culmination of the home loan approval process, the lender will scrutinize your financial condition to confirm consistency between your pre-approval and the accepted offer. Importantly, the lender possesses access to information concerning credit transactions and changes in employment that may have occurred in the interim period. Adherence to their guidance can make the difference between loan approval and rejection. If you have adhered to their recommendations, you are just a few signatures away from realizing your aspiration of homeownership.

Compliance with the correct procedures for securing a home loan is as pivotal as the actual quest for a home. You would not wish to invest your heart in a property only to discover that you do not qualify for the requisite mortgage. Therefore, it is prudent to commence preparations for your home loan journey a minimum of six months prior to embarking on your house hunt. This approach instills confidence in your ability to consummate the transaction upon finding your dream residence, while simultaneously ensuring that you secure a loan ideally tailored to your income and lifestyle.